Amidst industry challenges, Indian education technology startup Physics Wallah revealed on Friday that it has raised $210 million to expand its business through acquisitions among other means.

The company is now valued at $2.8 billion, a considerable rise from its previous estimate of $1.1 billion, thanks to the fundraising headed by Hornbill Capital and including Lightspeed Venture Partners, GSV, and WestBridge.

Founded in 2020, Physics Wallah is one of the many education technology companies (ed-tech) in India that provides both free and paid courses for various competitive examinations in the country. In an effort to stand out from the competition and make its courses more affordable for children living in lower-income areas of the nation, the company offers courses that typically cost less than $50.

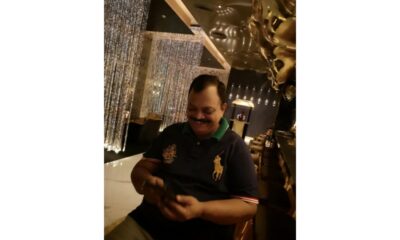

“We are not built for 1% of the country or 1% of the world, we are built for the remaining 99%, those who cannot go to these fancy coaching classes … now we enable different kinds of students,” In a recent interview, Physics Wallah CEO Alakh Pandey stated.

The startup offers free YouTube lessons under a freemium business model. There is a premium option for students who desire additional features like homework and tests.

According to the company, its sales increased by 250% year over year in the fiscal year that ended in March 2024. Pandey stated he anticipates the current fiscal year to have the “highest absolute” EBITDA. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is one metric used by businesses to gauge their profitability.

According to Pandey, the business is open to acquisitions as long as they provide them access to fresh users and content.

“Consolidation, we are open to it if it’s based on different geography that we cannot serve to, and if it caters to content and community first,” Pandey stated.

The CEO indicated the company’s prior equity investments. South Indian state of Kerala is home to the ed-tech startup Xylem Learning, in which Physics Wallah acquired a 50% share last year.

As long as a deal allows the business to gain access to fresh users and content, Pandey stated that it is open to acquisitions.

“If consolidation prioritizes content and community over geography and is based on a different geography that we cannot serve, then we are open to it,” Pandey stated.

The CEO indicated the stock investments the company has already made. Physics Wallah acquired a 50% share in Kerala, south India-based Xylem Learning, an ed-tech startup, last year.

Indian edtech problems

The organization, according to Pandey and his co-founder Prateek Maheshwari, is focused on a few major themes, such as the push for hybrid learning—both online and in traditional classroom settings—and increased internet access in India’s villages, towns, and smaller cities. All of this facilitates children’s access to education who come from less fortunate households.

Several companies sought to develop rapidly during the Covid epidemic, which led to the start of India’s ed-tech boom.

However, this growth also brought about a number of high-profile failures in the industry, such as the nearly bankrupt ed-tech company Byju, which was once valued at $22 billion and is currently dealing with many insolvency proceedings in India. A number of issues, such as aggressive acquisitions, excessive marketing expenditures, and poor management, have been blamed for its downfall.

Speaking about some of the setbacks in India’s ed-tech industry, Pandey stated that his organization is concentrated on the results it achieves for students as well as the content it provides.

“If you look at interviews or even the news stories of the actors you’re talking about, all they talk about is their outrageous valuation and the amount of money they have raised,” Pandey stated.

Education is a distinct entity. It differs from other startups in that it is possible to expand and discuss absurd valuations. Fundamentally, you have to acknowledge that you are genuinely trying to improve the lives of your students.

“I don’t believe the market has shrunk. A couple of players have struggled to perform post-Covid … but the learners are increasing year-on-year,” according to Maheshwari.

Regarding Physics Wallah’s future, Pandey stated that an IPO will occur but that a timetable will not be specified.

“An IPO is something that we will do. We want to have a strong governance in the company, we are working on that, forming a board of independent directors … it’s not that important for us when the IPO will happen, we are running the company like a public company,” Pandey stated.

Business4 weeks ago

Business4 weeks ago

Science3 weeks ago

Science3 weeks ago

Technology2 weeks ago

Technology2 weeks ago

Science2 weeks ago

Science2 weeks ago

Sports2 weeks ago

Sports2 weeks ago

Business2 weeks ago

Business2 weeks ago

Health2 weeks ago

Health2 weeks ago

Business2 weeks ago

Business2 weeks ago